Ensure an Agile and Flexible

Servicing Process

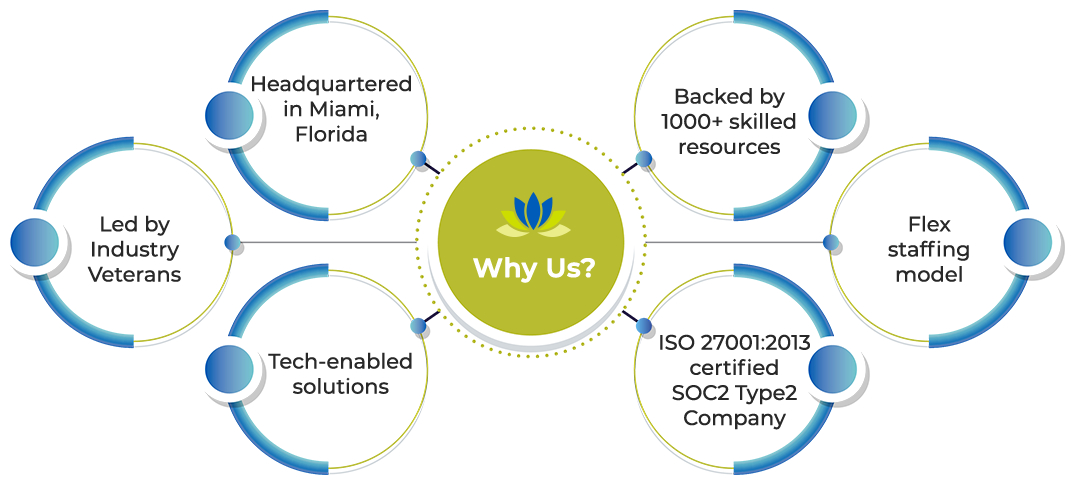

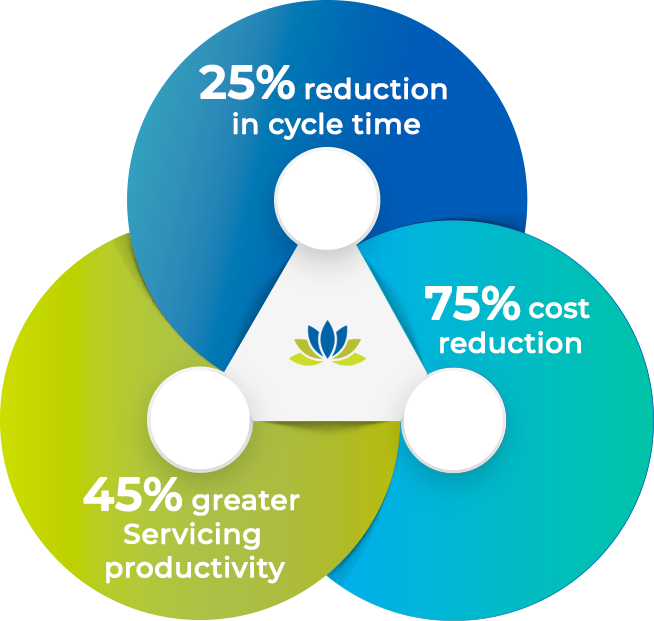

With 20+ years of deep domain expertise, and being led by mortgage bankers who can easily identify the challenges involved with mortgage servicing, Nexval can help you ensure an agile and flexible servicing process with top notch tech-enabled services.

Core Servicing

Escrow (Tax, Insurance)

MI Premium Disbursement Payoff

Investor Reporting

Customer support (Email)

Payment Ops

Cash Ops

Special Loans

Corp Adv/Escrow Recon

Bank Recon

Loss Mitigation

Proprietary Mods

Deed in Lieu

Document Indexing

Short Sale

Skip Tracing

Call Monitoring

Foreclosure

FCL Referral

FC Document Preparation

FC Executed Doc -QC

FC Timeline Management

1st Legal, Judgement,

Sales Schedule

Title Curative

Foreclosure Sale Bid

Comp Fines/

Attorney Oversight

Bankruptcy

Bankruptcy Set-up

POC Filing

Attorney Fees Approval

MFR Review/ Filing

Consent Order Monitoring

Discharge/ Relief

Pre/ Post Petition

REO

Pre-Marketing

Marketing

Agent/Broker EO

License Validation

Property Preservation

Eviction

Loan Boarding &

Ancillary Services

Data Integrity Audits

ARM Audits

Claims Processing

Business Process Mapping

FLOD Testing

Compliance

Servicing QC

HMDA Scrubbing

OFAC/ QWR

SCRA Review

Reverse Servicing

Proprietary Mods

Deed in Lieu

Document Indexing

Short Sale

Skip Tracing

Call Monitoring

How Nexval helps?

Quick and

Efficient

Processing

Availability

of

Qualified

Resources

Scalability of

Manpower /

Flexible

Manpower

Meeting

Compliance

Needs

Pre-underwriting

Efficiency

Workforce

Flexibility

Global

Outreach/

Expansion of

business

Access to

the Latest

Software

Security

Chance to

focus on core

competencies

Increased

operating

capacity

Improved

TAT

Enhanced

customer

experience

Process

Efficiency

Enhanced

Transparency

Better KPI

Cost-effective

Services