The housing market is a dynamic and ever-changing sector of the economy, deeply influenced by a myriad of factors. One of the most critical aspects that can significantly impact the housing market is mortgage interest rates. Over the years, mortgage market rates have experienced fluctuations, affecting both buyers and sellers.

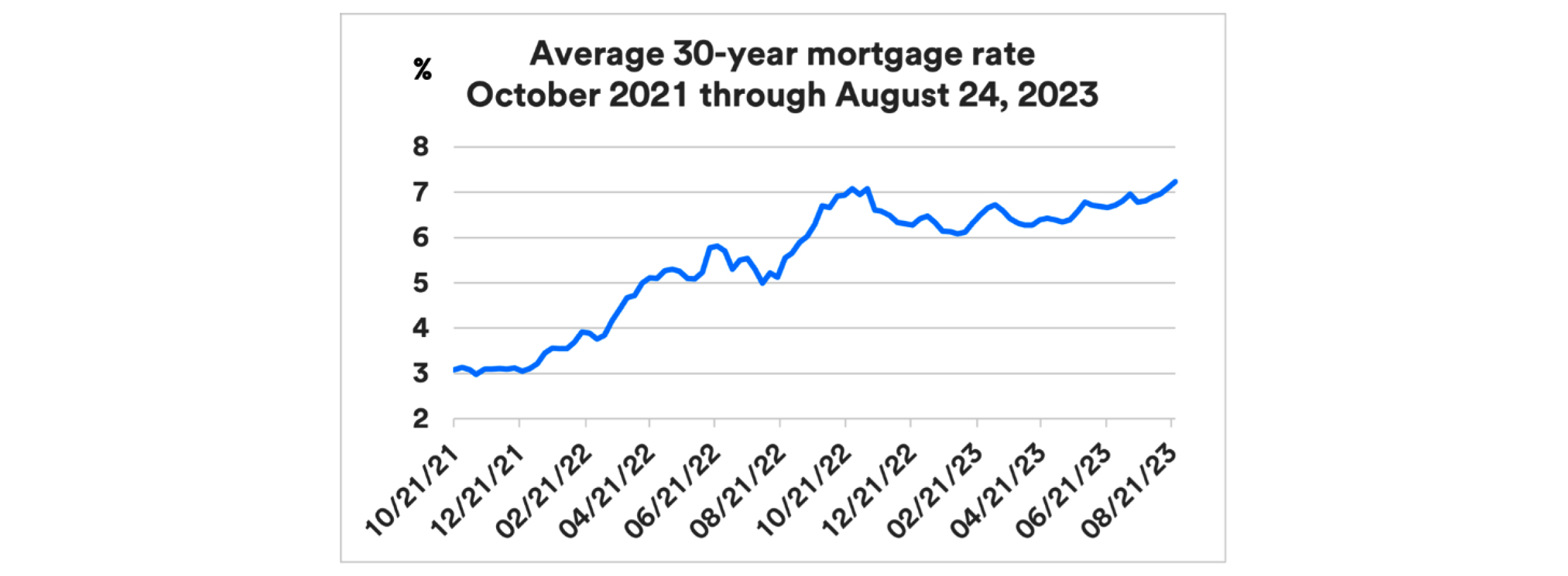

In the current scenario, mortgage rates appear to have undergone a turbulent journey. According to Freddie Mac, in August, the rates continued their upward trajectory, with the 30-year fixed-rate mortgage hitting its highest point since 2001 this week. Furthermore, the average 30-year fixed-rate mortgage saw a slight decrease to 7.18%, down by 5 basis points from the previous week’s rate of 7.23%.

As per Forbes, Housing market analysts anticipate elevated mortgage market rates due to economic uncertainty and the Federal Reserve’s inflation-fighting policies. However, there is a possibility that rates could decrease later in the year, contingent on inflation cooling down to some extent.

Impact of Mortgage Interest Rates on the Housing Market

Mortgage interest rates have a profound impact on the housing market, influencing various aspects of the industry. When rates are low, it becomes more affordable for individuals to finance home purchases, stimulating demand for homes. This increased demand typically leads to higher home prices, benefiting sellers. Conversely, when rates rise, borrowing costs increase, which can deter potential buyers due to higher monthly payments.

As a result, demand may weaken, potentially causing home prices to stabilize or even decrease, which is advantageous for buyers but can be challenging for sellers. Additionally, higher mortgage market rates can affect homeowners looking to refinance, as the savings from refinancing may not be as substantial.

Mortgage rates also affect the overall health of the economy. Lower rates can spur economic growth by encouraging home purchases, while higher rates can have a cooling effect. Overall, mortgage interest rates play a critical role in shaping the dynamics of the housing market, impacting affordability, demand, prices, and the broader economy.

Read More: Rising Mortgage Rates: How Automation Can Help Lenders Maintain the Margin

How Higher Mortgage Rates Affect Housing Market Dynamics

Higher mortgage rates can have a significant impact on housing market dynamics. These effects can ripple through various aspects of the market, affecting both buyers and sellers. Here are some of the ways in which higher mortgage rates can influence the housing market:

Reduced Affordability

Reduced affordability in the housing market, caused by increasing mortgage rates, has a profound impact on various segments of the population, particularly first-time homebuyers and those with lower incomes. Higher monthly mortgage payments can force individuals and families to reconsider their housing options, potentially delaying homeownership and influencing the overall dynamics of the housing market. Addressing this issue often involves a combination of economic policies and individual financial planning to make homeownership more accessible to a broader range of people.

Read More: Do’s and Don’ts of Servicing Mortgages for First-Time Homebuyers

Slower Home Sales

Rising mortgage market rates have a complex impact on home sales. While they can create urgency among some buyers, they can also lead to hesitancy and reduced affordability for others. The net effect often depends on various factors, including the magnitude of the rate increase, the overall economic climate, and individual buyer circumstances. Slower home sales, as a result of higher rates, can have repercussions throughout the housing market, influencing inventory levels, pricing dynamics, and overall market sentiment.

Impact on Existing Homeowners

Increased interest rates can make mortgage refinancing less attractive for existing homeowners, reducing their ability to lower monthly payments or tap into home equity. This, in turn, can lead to decreased consumer spending, which has wider economic implications. Homeowners may face financial challenges, and policymakers may need to intervene to mitigate the negative effects on individuals and the economy.

Stabilization of Home Prices

The stabilization of home prices is an important and often favorable outcome in the housing market, and it can be influenced by rising interest rates. Soaring interest rates can influence the demand and supply dynamics, leading to a reduction in competition among buyers and a more balanced market. This, in turn, can contribute to the stabilization of home prices, which can benefit both buyers and sellers by enhancing housing affordability and promoting better sustainable housing market dynamics. The achievement of price stabilization is frequently regarded as a favorable result, with the potential to promote increased long-term stability in both the housing sector and the overall economy.

Investor Behavior

Real estate investors often consider mortgage market rates when making investment decisions. Increasing rates can impact the attractiveness of real estate investments, potentially leading to shifts in investor behavior. When mortgage rates escalate, it can have far-reaching implications for the attractiveness of real estate investments.

Read More: How Your Mortgage Business Can Respond to Market Volatility

Rising mortgage rates increase borrowing costs, potentially reducing ROI, and prompting some investors to explore alternatives or adapt their strategies. On the other hand, low mortgage rates boost real estate’s allure, lowering financing costs and spurring demand. Investors may seize opportunities to acquire properties and expand portfolios.

Adapt to Shifting Mortgage Rates with Nexval

Surging mortgage market rates have far-reaching effects on the housing market. As rates continue to fluctuate, it’s crucial for stakeholders in the housing and lending sectors to stay informed and adapt to changing market conditions. Nexval understands these fluctuations and offers innovative solutions that empower lenders and servicers to navigate the challenges of a rising-rate environment while maintaining the efficiency and transparency of the lending and servicing process. By understanding these dynamics, mortgage businesses can better prepare for the ever-evolving landscape of the housing market and navigate it smoothly.

Talk to our team to learn more strategies to boost sales in a difficult mortgage market.