Nexval Origination Process Automation is Designed for Your Business

At Nexval, we bridge the gap between loan origination systems (LOS) like Unifipro, Lakewood,

Fiserv, Encompass, and others to lay the foundations for automation in mortgage origination. Businesses can

gain from a connected workflow and unified origination process management. Nexval delivers mortgage

automation bots that work across LOS platforms to dramatically shrink the workload involved in loan setup,

document and data reviews, and closing procedures.

Action a Smarter, More Improved Loan Origination Workflow

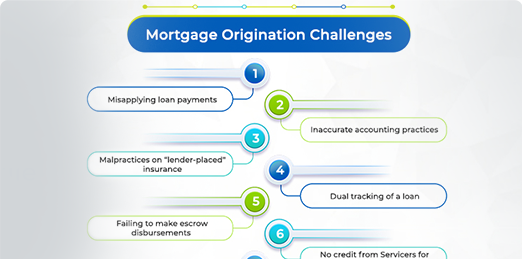

Automated origination means that you leverage RPA mortgage bots and AI tools to complete key steps in the

early stages of a lender-borrower relationship. From loan setup and document reviews to risk-free

underwriting, automation in mortgage origination completely transforms how you approach ops. This could

benefit every origination channel; be it retail or wholesale.

Intelligent automation improves essential elements of the origination journey:

| A 24/7 loan setup process that is standardized and free of effort duplication | Automated validation of LOS data for 100% first-pass accuracy | Faster turnaround time for new relationships without adding overheads |

| Greater agility to accommodate new types of origination documents and new regulations | Assisting human workers to improve the employee experience and eliminate mundane tasks | Automatic multi-level checks, quality control, and reviews via RPA mortgage bots |