In June 2017, The Federal Reserve Bank of Chicago drafted a white paper on how “Fintech has been playing an increasing role in shaping financial and banking landscapes.” The paper explores the advantages and disadvantages of Fintech loans and other loans going through a more traditional banking channel.

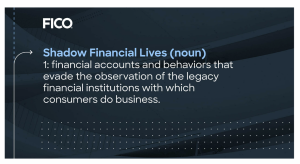

Undoubtedly, the lending environment has changed significantly due to the influx of technology tools designed to streamline the lending process. Since 2010 the number of non-bank lenders using Fintech tools has seen unprecedented growth. A lending environment term, Shadow Banking, has been used to define a collection of non-bank financial conciliators that provide services that are very similar to established banking institutions but are outside the normal banking regulations. Over the past few years, the term of shadow banking has been replaced by “private debt market” and has tripled in size with lending power of approximately $1.2 trillion,” says Steven Kaplan, a professor at the University of Chicago.

The question lies with the main purpose of shadow banking. Although Fintech tools are responsible for the streamlined lending process, are the creators of this technology guilty of usurping the strict lending laws established to protect consumers and even investors?

Realistically, Fintech tools have never been so necessary. In the mortgage industry, we no longer sit down with the borrower to establish a trusting relationship. We run ad campaigns online and through various media outlets. We entice the most vulnerable borrowers, first-time buyers, with catchphrases like “no closing costs, accelerated closings, and 100% online.” To most of us nowadays these enticements are exactly what we’re looking for. So, when do the issues with Regulatory Compliance come into play? Fair lending and disparate treatment are two of the most notable risks. How lenders gather data, look at credit reports, provide the same level of services to those who have computers and access to Internet services, are still being evaluated.

On the brighter side, the home sales boom of 2020 and 2021 might never have happened without Fintech tools. Traditional lending practices came to a hard halt due to pandemic conditions and restrictions that followed. Appraisals were done without seeing the inside of a home, a truly paperless process was used as banks closed their office doors to avoid unnecessary exposure to the virus. Remote banking operations became the norm across all types of lenders with credit unions and other private mortgage lenders taking the lead.

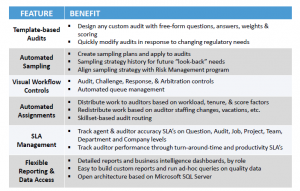

Digital mortgage operations have become the norm in 2021 and so will the digitization of compliance and risks directly tied to these new processes. Today’s regulatory agencies, such as CFPB, FNMA. FHLMC, FHA, VA, and USDA, have not changed the criteria implemented for auditing the methods used for loan processing, underwriting, and closing. Literally, every step of the process is auditable. In-house pre-audits have been commonplace for many years. Auditing one’s own practices have become necessary to avoid violations and possible fines. So, whether you are a fully automated lender/servicer or a traditional banking lender, the rules apply across the board. When a lender is using today’s auditing tools, the audits must mirror the compliance mandates by each regulatory entity.

Mortgage companies, banks, and credit unions are continually being audited for regulations falling under Reg Z, Reg X, Reg B, FACTA, UDAAP, GBLA, HMDA, Red Flag, and FCRA. These regulations are auditable no matter what software or lending platform your company uses. Although Fintech tools have been able to reduce some of the scrutinies, all eyes are now on automation and how well it protects privacy data, determines creditworthiness, loan quality, the price of credit (interest rates and points), and the hottest topic “Consumer Privacy.”

5 Areas of Internal Audits that will Keep You Compliant when using Fintech Tools

- Mortgage Originations: Before your practices are audited, go through an internal audit that includes reverifications, file reviews, appraisal reviews, credit report analysis, findings, debt-to-income ratios, and reporting requirements.

- Mortgage Servicing: Be prepared for any external auditor to closely exam your mortgage servicing processes, including Loan Boarding Review, Escrow Review, Servicing Compliance Reviews (Investor, GSEs, and Internal QA).

- Customer Service: Monitor your customer service activity to ensure you are meeting compliance requirements for Call Center Agent Quality and Call Compliance Reviews. This includes maintaining a high level of data protection.

- Default Servicing: Keep up to date with ever-changing Default Servicing Regulations, such as Loss Mitigation Review (Processing, Underwriting, and Closing); Foreclosure Process Review, and Bankruptcy Process Review. Find any errors before external auditors do.

- Third-Party Reviews: Consent Orders and Investor Reviews

If your company is utilizing Fintech tools for the total loan process, origination through closing, you need to look for Fintech auditing tools that complement your mortgage technology platforms. Don’t put your company at risk by not being prepared for audits. Fintech is where Mortgage Technology has gone and it’s not going back. Increase your transparency….and see the possibilities of a partnership between Compliance and Technology.

Veritiq, a member of the Nexval group of Companies offers Quality Control and Quality Assurance products for the mortgage and banking industry. Its flagship product, ARC, is a workflow-enabled, template-based software, providing management with a consolidated, organization-wide view of your Audit, Risk Management & Compliance programs using a single technology.

ARC (Audit, Risk Management, and Compliance)

Find out how software can solve all your auditing needs and request a demo by emailing: info@veritiq.com.