Leverage expertly crafted

Mortgage Servicing

Solutions to outmatch

the competition

In the post-pandemic world, the mortgage servicing industry is facing several challenges including compliance issues under the moratorium extension, fluctuating repayment laws and orders, and many operational hurdles. For instance, credit reporting continues to be an area filled with confusion.

Servicers are left with uncertainty on how to address post-forbearance defaults that have not been cured. As the mortgage industry is going to get over forbearances post-moratorium, there will be an undeniable and necessary focus on deferrals and other loss mitigation solutions aimed at curing the delinquencies caused by forbearances. It will be important for servicers to ensure they have a

compliant and robust process to deal with the challenges and maintain regular workflow

at the same time.

With deep domain knowledge, Nexval is equipped to handle all forms of Portfolio and Investor loans including Non-Performing Loans, Re-Performing Loans, and Performing Loans. Nexval’s comprehensive support functions across servicing value chain cover platforms such as MSP, LSAMs, LPS, and others.

Core Servicing

Read More

Loss Mitigation

Read More

Foreclosure

Read More

Closing

Read More

Post-Closing

Read More

Funding

Read More

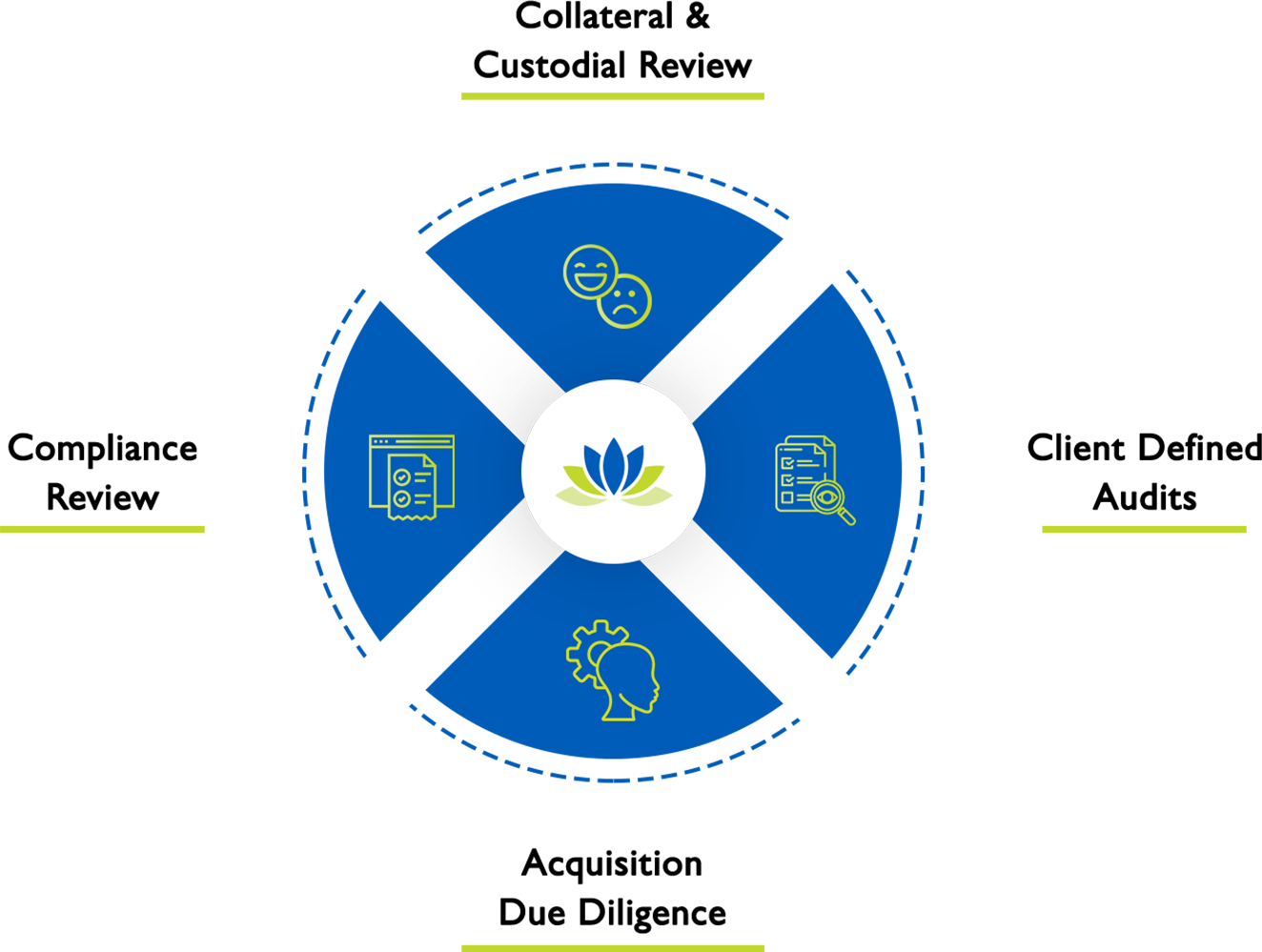

Quality Control Review

Nexval offers a full suite of Mortgage Quality Control and Loan Review Services to reduce risks.

During our services, we work closely with you to understand your requirements while providing trained resources to meet those requirements; but our services do not end there. We assist you throughout all the while to improve the process and gain additional efficiency and also help you to lower your cost to underwrite loans.

Apart from providing trained resources to meet your requirements, we also work with you throughout the process to improve the flow and help you ensure cost efficiency for underwriting loans.

CASE STUDY

Issue

Description

ABOUT THE PROCESS

The Mailbox Management team is responsible for reviewing requests/ queries received in various designated inbox from various parties

Post Review, the team is required to route the requests to the designated teams to provide resolution

The process of segregating and allocation required extensive human effort which could have been directed towards important functions

There was no visibility on the resolution process or the escalation procedure which let to Delays, Non Compliance, and Customer Dissatisfaction

Solution

Nexval designed a 2 pronged strategy to seamlessly manage the function. Self Service Platform Advanced queue management platform

Self Service platform was designed to provide resolution for most common issues without the need to raise a request

NexQ was linked with DocuChief to automatically identify and segregate issues raised based on the content and field selection.The system would automatically route all such requests to the concerned departments and keep a log of the resolution time frame with active triggers to handle escalations.

Value Add

Delivered

Reduction of assigned FTE's by 85%

Route TAT optimized by 10%

Timely resolutions increased by - 53%

Escalations reduced by - 62%

Adherence to CFPB compliance

Get in Touch