Ensure an Agile and Flexible

Origination Process

Processing

Loan Officer to Processor QA

Loan set-up

Order & follow-up on

third party services

Welcome calls and borrower

communication

Order & evaluate credit docs

Update LOS

Submit to underwriting

Underwriting

Income and appraisal

component underwriting

AUS validation

Lender specific overlays

Condition clearing

Final approval/clear-to-close

Closing/funding

Pre-funding audit

Initial Closing disclosure

Issue closing instructions

and final closing disclosure

Review preliminary

funding docs

Request corrections

from title company

Prepare wire or order wire

from warehouse bank

Loan setup

Review for minimum

submission docs

Loan set-up

Order & follow-up on

third party services

NMLS, LDP/GSA, MERS

Update LOS

Review checklist for

accuracy

Submit to underwriting

Order Payoff

Order HOI

Underwriting

AUS validation

Lender specific overlays

Broker communication

Condition clearing

Final approval/

clear-to-close

Pre-Purchase Reviews

Review credit/closing

documents for

completeness/accuracy

Analyze income, credit,

assets, appraisal,

sales contract, and

other documents

Order and review fraud,

credit, compliance and

other third-party information

and services per guidelines

Identify deficiencies/

suspense items

Review follow-up documents

Document Management

Sort and index documents

Review documents for

completeness and accuracy

Complete and upload

applicable worksheets

Manage follow-up

documents guidelines

Pre-Purchase Reviews

Review credit/closing

documents for

completeness/accuracy

Analyze income, credit,

assets, appraisal,

sales contract, and

other documents investor

Order and review fraud, credit,

compliance and other

third-party information

and services per guidelines

Identify deficiencies/

suspense items

Review follow-up documents

Trailing Documents

Track and follow up

on trailing docs

Review and index

received trailing docs

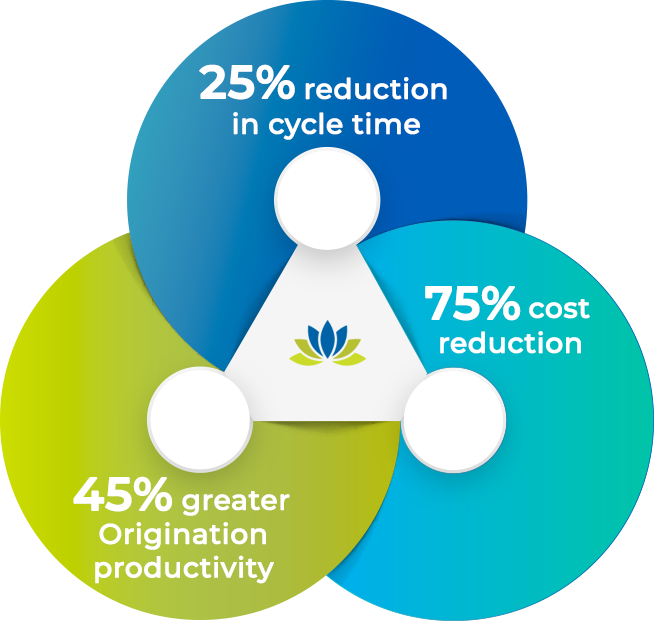

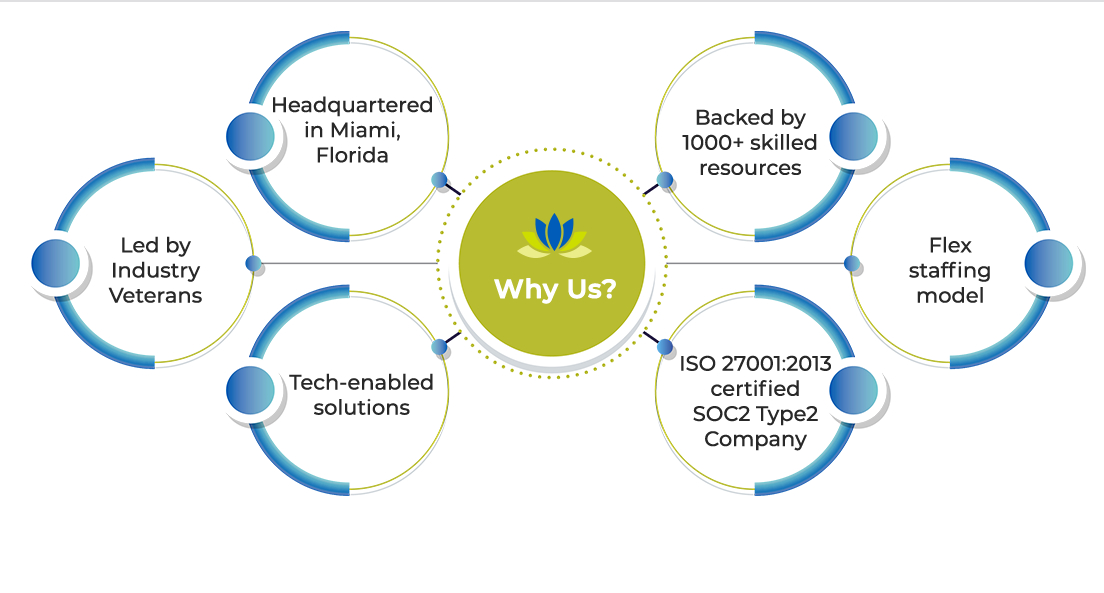

How Nexval helps?