Several years ago, it was reported that blockchain technology had not yet disrupted the financial services industry. What disruption does is make us open our eyes, take notice, and realize that “we” are part of the disruption whether we like it or not. So why all of the sudden are we paying such close attention to Blockchain Technology? PwC offers this: Blockchain is a place where transactions occur without an intermediary, in real time, and with unalterable records. Sounds good for us, right?

According to Ernst & Young, “Blockchains will do for networks of enterprises and business ecosystems what enterprise resource planning (ERP) did for the single company. Blockchain will integrate information and process [it] within and across enterprise boundaries and has the potential to streamline and accelerate your business processes, increase protection against cybersecurity and reduce or eliminate the roles of intermediaries.”

One of the surprising facts about blockchain is that it generally involves cryptocurrencies, such as Bitcoin. Immediately, skepticism enters the picture. The mortgage and banking industry has always held the title of “the most regulated” industry in America. This begs the question, if we exclude the use of intermediaries and embrace direct peer-to-peer transactions between buyers and sellers, where is the oversight?

Over the past 10 years so much has disrupted our industry. Each disruption generally includes new technology, a new thought process, a new way of doing things with fewer people while having the highest level of security. But is the financial services industry ready for blockchain disruption?

A company called “builtin” posts this in large letters across the homepage of their website:

BuiltIn describes itself as “a national community united around a shared passion for tech, offering content and career opportunities, whether you want to work at home or in office.” This company is comprised of a think-tank of techies who all rally around the idea to instill trust in the blockchain.

Builtin showcases 11 companies that work as conduits between lenders and borrowers. One company, FIGURE, out of San Francisco, is actively offering home loans.

Borrowers like the options they have when using a blockchain lender. The applications are 100% online, with multiple term options and the ability to do a rate lock 24/7. They do require appraisals, loan documents, credit checks, title, settlement and recording fees, and of course a down payment. One of the biggest differences is that your information is not shared with anyone outside the lender. Data from a regular loan is often owned by a business, but with a blockchain, the data is collected together in groups that are known as blocks. When each block of data is filled, the blocks are chained with other blocks that are full, thereby creating a blockchain.

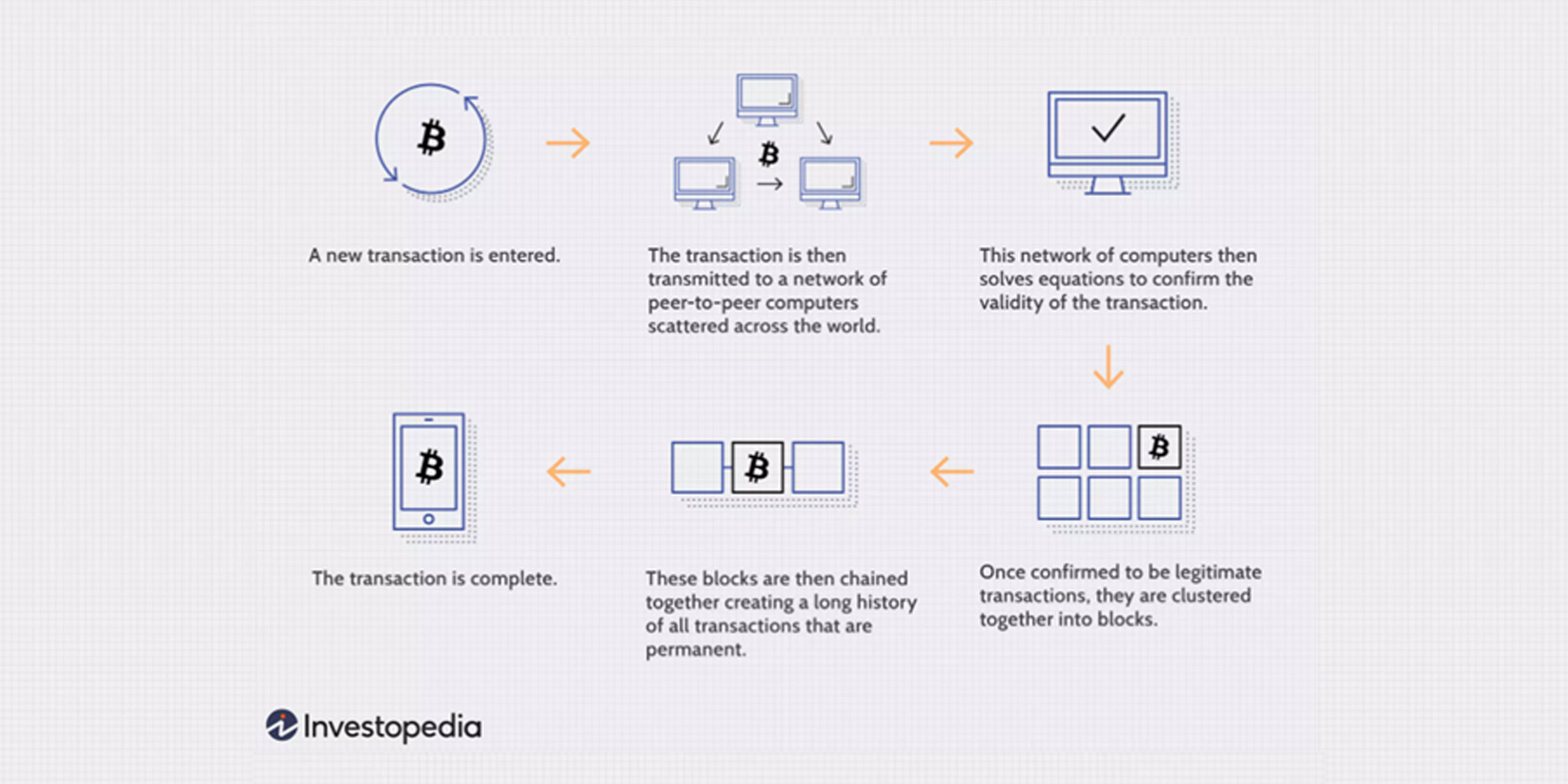

In researching this information, we cited Investopedia. The graphic below provides the process used for blockchain data.

Investopedia KEY TAKEAWAYS:

- Blockchain is a specific type of database.

- It differs from a typical database in the way it stores information; blockchains store data in blocks that are then chained together.

- As new data comes in it is entered into a fresh block. Once the block is filled with data it is chained onto the previous block, which makes the data chained together in chronological order.

- Different types of information can be stored on a blockchain but the most common use so far has been as a ledger for transactions.

- In Bitcoin’s case, blockchain is used in a decentralized way so that no single person or group has control—rather, all users collectively retain control.

- Decentralized blockchains are immutable, which means that the data entered is irreversible. For Bitcoin, this means that transactions are permanently recorded and viewable to anyone.

Blockchain technology has yet to be proven as the superior choice for lenders or borrowers. The required documents do not disappear because the required intermediaries are still in the process lifecycle of a loan. Although we may be headed toward a lending process that completely eliminates intermediaries, our industry is not there yet. And, even if the case were made for streamlining costs and closing times, it’s highly unlikely that federally-regulated lenders like Fannie Mae, Freddie Mac, would jump on board this idea.

The one area of mortgage servicing that is expected to benefit greatly from the use of Blockchain is title services. According to the American Land Title Association (ALTA), more than 25% of title reports note some type of title defect. So, will blockchain technology streamline the time and cost of recording title documents without human intervention thereby eliminating defects in the data? We have seen Covid-19 push us into e-closings using e-docs. This is the first step of embracing blockchain technology. According to Property Records Industry Association (PRIA), over 85% of the U.S. population resides in jurisdictions that e-record.

Blockchain technology will eliminate tampering of ownership records that reside in a county clerk’s office and transfer the land records to a distributed ledger. Every record builds upon the next record, creating a dependency from the first record to the second record, the third record to the fourth, and so on. This immutable ledger of record establishes an increase in trust and minimal fear of fraud. According to a 2018 Forbes article,

“The inner blockchain world will convince you that the title insurance business is at risk of survival. Many believe that intermediary businesses are all on their last lifeline. Blockchain technology will inevitably connect the parties of a real estate transaction and eliminate many of the services a real estate agent or title officer provides.”

Forbes also points out areas of the real estate transaction where there are gaps yet to be worked out in successfully using blockchain for 100% of the title services:

Title Commitment / Policy /Record Keeping: Tasks like securing documents such as bankruptcies, divorces, child support, IRS liens, non-recorded defects, and other items where a title company is required to gather and the document is not yet ready for blockchain automation.

The Closing: Rules can be written and procedures created to finalize prorated taxes, escrow amounts, and results of an inspection. “However,” Forbes asks, “who is going to be at this digital closing table to mediate between parties in regards to disputes still pending, authenticate a payoff statement from a private creditor or lien holder, obtain a payoff from material men, pay off all utility bills or verify a power of attorney?”

Unlike healthcare, marketing, and energy blockchains, buying real estate requires monetary transactions to begin and end the process. It also requires title attorneys and closers to finalize many transactions. Although we may not be there yet, Deloitte provides us its vision on the effects of blockchain on CRE’s (commercial real estate).

“In our world of continued technological revolution, a most new technology comes with a promise to improve business and profitability. And whether one likes it or not, there can be a threat to survival if a business doesn’t adapt to the changing times. As blockchain technology continues to evolve, it is challenging status quo and perhaps requires CRE companies to better understand the technology and revisit their existing business model, strategy, processes, and financial plan.”

There is a lot of food-for-thought in this ideology. Unlike non-highly regulated industries, financial services and its components, are laden with regulatory mandates. As we’ve seen throughout the decades, change is not easy. Shifting control from “intermediaries” to the “direct source” will take years of legislation. Each intermediary will clammer to protect its space while new industries and new occupations will get ready to jump in and take over. This is a perfect example of the evolution of technology. We can be guaranteed that what’s here today can, and will, be changed. As Will Rodgers said, “Even if you are on the right track, you’ll get run over if you just sit there.”

Stay up to date on the industry use of blockchain technology, RPA & Workflow Automation initiatives @ Nexval.com.