THE CHALLENGE

Mortgage Companies handle numerous paper documents daily, which are needed to be managed and processed accurately and on time. A minor error in the documentation processes might lead to a major loss for the company. Many mortgage companies till date rely heavily on manual labor for executing the tasks of document classification and data extraction, which slows down the efficiency of the entire method significantly.

NOW, WHAT MIGHT BE THE SOLUTION?

The most effective resolution for the Mortgage Companies right now is to opt for Intelligent Document Processing (IDP). Mortgage lending does involve complex operations but they are predominantly rule-based – this makes the industry one of the most ideal candidates for IDP.

To explain it further, IDP is a process of assigning rule-driven tasks to AI-based software that can navigate and perform those tasks just like a human. It is capable of controlling application through existing commands delivering work at a much faster rate with hardly any error. This type of IDP can interact with varied systems of IT at the GUI (Graphical User Interface) level and not at the system level, which makes the process adequately secure for Mortgage Companies.

Several mortgage companies have achieved prominent process improvement and cost optimization objectives through Business Process Outsourcing (BPO) and improved technology forums such as Intelligent Document Processing. It can help accomplish extensive operational value additions at a lowered cost compared to manual processes or conventional databases.

IDP is presently one of the most prominent avenues of the Loan Process Automation that helps Mortgage Companies lower their costs significantly. As per projections, the Compound Annual Growth Rate (CAGR) of the entire domain of Loan Process Automation is expected to increase by 60.5% worldwide and the total market size is supposedly valued at US$ 5 billion by the end of 2020.

Let’s take a quick look at how IDP can facilitate Mortgage Process significantly:

Docuchief (DC), a flagship technology product of Nexval, is a product suite of the similar manner that leverages IPD and its ML/AI algorithms to simplify and automate document processing across the US Mortgage Banking Industry. Developed on a tiered architecture, DC can be used both as a hybrid solution or a cloud solution.

Docuchief is predominantly used for Document Indexing (alternatively termed as Document Classification) and Data Extraction.

DC is a one-stop solution for Document Processing, thanks to its robust QC Model and consistent Workflow Management. It can receive shipments from clients, apply business logic and deliver data in various formats like images (.png/.jpg), PDF, database schemas, spreadsheet (Ms Excel) and XML. It works well with both structured and unstructured data.

Docuchief can be broadly categorized into:

- DC Dex (for Document Indexing)

- DC Xtract (for Document Extraction

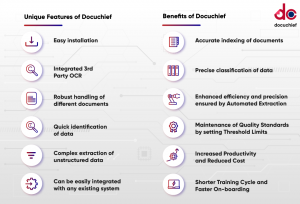

Here’s how Docuchief can be advantageous for your Mortgage Business: