Full digitization of the mortgage process may be a long way off, but it’s undeniable that technology underwent a revolution during the COVID pandemic.

Software platforms were fast-tracked in response to lockdown rules, so that originators could carry on ‘virtually’ as normal and engage with their clients from the comfort of their homes.

The result was that the mortgage industry was one of the few sectors that actually flourished during what was arguably the worst socio-economic crisis in living memory. And high-tech took center stage.

Read more: Don’t fear the tech, head tells feet-dragging brokers

A self-styled ‘mortgage technology guru’, he has devoted much of his 25-year-long career on improving mortgage process efficiency using automation.

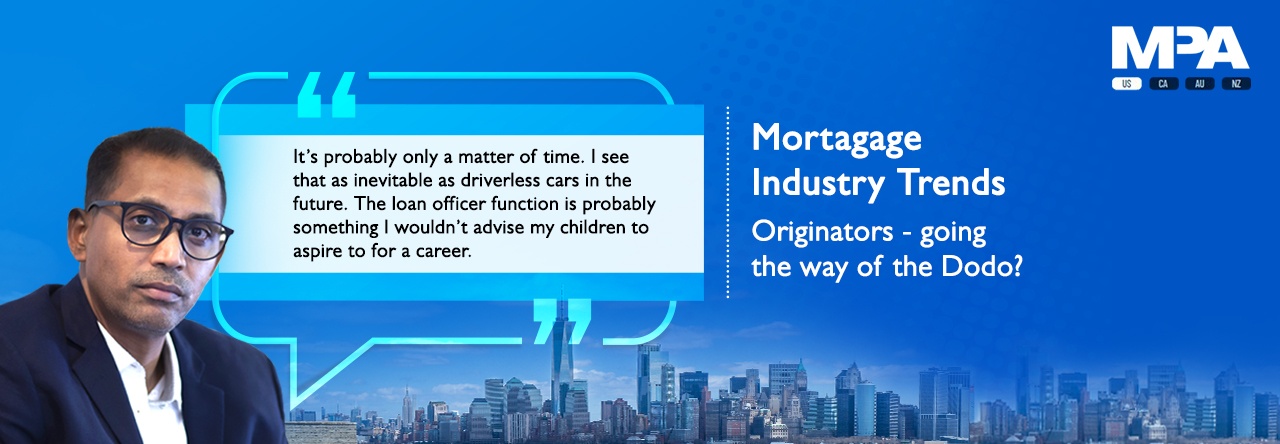

Nothing unusual about that, but he has gone one step further by claiming that technology will consign LOs and brokers to the history books, no less.

“It’s probably only a matter of time. I see that as inevitable as driverless cars in the future. The loan officer function is probably something I wouldn’t advise my children to aspire to for a career,” he said witheringly.

“But as you can see with many of the point-of-sale systems out there generally, the trend is to make the process simple,” he said.

While it might be a bit of a stretch to suggest that originators are surplus to requirements on the strength of that argument, Sarkar’s belief in the boundless possibilities of high-tech is widely shared, especially in the fintech sector.

He said the process to replace LOs had already started. “The personal loan officer’s work was really being an intermediary for document processing, and thanks to all electronic connections with the banks, that job has been eliminated.”

He cited the move towards a centralized operations system where there are no local loan officers as an example, dismissing the oft-held argument that loan officers are needed to provide lead generation and a human touch.

“A section of the public still wants to talk to somebody on the phone and they might want clarification, (maybe to discuss) a systematic system issue, but they can do the work at their pace and (not have) the pressure of a loan officer wanting to close the sale,” he said.

He cited fraud analysis – a field he has devoted his entire career towards – as another area that “can be completely automatable”. Using third-party data sources, mortgage companies can create a visual map of fraudsters’ transactions, obtaining crucial evidence to help apprehend criminals – more often than not straw borrowers who simultaneously apply for multiple mortgages.

Read more: Evolve VP Tim Anderson back with a vengeance: “I’m going to finish what I started”

One aspect that Sarkar was less sure about is the use of cryptocurrency in the home buying process. Wholesale lender UWM recently ditched its short-lived plan to accept Bitcoin as payment, but according to the latest Redfin survey, 12% of first-time homebuyers said selling cryptocurrencies helped them to save for a down payment, a figure that had increased from 5% in 2019.

“The risk of using cryptocurrency to pay for a mortgage is from the receiver side. Accepting these currencies is difficult on face value, they have to be taken against a stable currency such as the dollar and convert it back and forth,” he said.

By contrast stablecoins – another type of cryptocurrency which is pegged to a physical currency – could have more uses and provide more credible alternatives to Bitcoin.

Either way, Sarkar believes cryptocurrencies are here to stay, even as nation states struggle to define their relationship with them, or even accept their very existence.

Unsurprisingly, Sarkar’s overall vision is that of a more decentralized mortgage industry, one that may even do away with mortgage banks in their current form.