Post-COVID 19…What does this mean for Property Preservation companies?

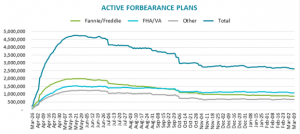

Approximately 2.7 million homeowners are participating in some form of a forbearance plan, according to the Mortgage Bankers Association. And, the lion’s share of these mortgages is held by private lending services and not federally-backed lenders, like Fannie Mae, Freddie Mac, VA, USDA, FHA, etc.

On February 16, 2021, President Biden extended the foreclosure moratorium to June 30, 2021. Homeowners will be allowed to enroll in a mortgage payment forbearance program or extend their current forbearance programs every three months up through June 30th.

Forbearance is different from foreclosure. Under the COVID Forbearance Program, homeowners are allowed to pause, and in some cases, reduce their monthly payments up through the forbearance end date. However, the dates of the forbearance period may vary based on who owns the loan. The June 30th date is the latest extension for Freddie, Fannie, USDA, FHA and VA loans. But, many private lenders are following suit to keep people in their homes. Nevertheless, private mortgage companies are not mandated by the federal government to follow suit, so some homeowners could fall through the holes of this safety net. The backlash of millions of homeowners losing their property would have devastating effects on the economy.

In the end, many mortgages will end up in a program called payment deferral. This method of repayment will result in the unpaid mortgage payment to be added to the end of the loan. In some cases, this could extend an existing loan by 2 years. However, if the homeowner sells or refinances, the debt would be due at closing.

“Another option,” says Karan Kaul, a senior research associate at Urban Institute, “is a permanent change to the terms of the loan, called a loan modification. During a loan modification, a lender adjusts the loan payment terms and or interest rate resulting in a lower monthly payment.”

So, for those who slip through all the holes of the safety net, because they don’t fit into any of the safety buckets, what will their demise be…most likely, foreclosure. We know most of the borrowers who are in forbearance or performing under one of the loan-modification programs, have a chance of full recovery and will not face losing their homes. But what about those who remain unemployed, or underemployed, and cannot continue making mortgage payments after the moratorium is lifted? This is where most financial analysts share the concern. Even with the job rate increasing, the number of people still on unemployment is staggering and we are just 2 months out from the June 30, 2021 deadline.

The latest news release from The Bureau of Labor Statistics shows the unemployment rate for the end of February 2021 at 6.2%. Although that is improved over the 14% rate in May of 2020, the quality of jobs gained is a big issue. Most of the large job gains were in retail, hotel, and other hospitality sectors, while healthcare, education, and construction showed much smaller gains. Lower paying jobs versus higher-paying jobs will have an adverse effect on those facing possible foreclosure post-June 30, 2021.

In the February 2021 edition of DSNews, the writer poses the million-dollar question: “What are foreclosures going to look like once the foreclosure moratoria and forbearance programs come to end? And will we see all those borrowers in forbearance end up in default?”

Their answer is we probably won’t see all these borrowers in default, but they caution that “servicing professionals should prepare themselves nonetheless.” Stepping back a year would suggest we could see upwards of 4 million homeowners move to foreclosure and lose their homes. But, the safety nets the government has put into place suggest the numbers may be considerably less. In March of 2021, Black Knight’s McDash Flash Forbearance Tracker gives us a historical view of what’s happened to date.

In the last quarter of 2020, The Federal Reserve Bank of St. Louis predicted we would see 500,000 single-family home foreclosures by the end of the pandemic. An area of property losses that the ‘Bank’ didn’t consider is Commercial Property. In 2020, COVID introduced most the traditional bricks and mortar companies to the concept of remote workers. Not surprisingly, this necessary move from the office-to-home took flight, and for the most part, has not negatively affected the bottom-line for businesses. However, hotels, restaurants, and retail have seen a 40% closure rate and are still trying to recover. Predictions are that many will not be able to recoup their losses and will remain closed forever. Add to that the Rental Market, and suddenly the probability of a higher foreclosure rate is impending.

Many landlords are not big conglomerates, but small family investors. According to GlobeSt.com, “90% of the rental properties are owned by mom and pop investors who own fewer than 10 rentals.” With the eviction ban in place, the outcome can have devastating effects on the rental property industry. The measures put in place to help keep people in their homes have put many landlords at high risk for default.

So, what does this mean for the Property Preservation sector of the real estate industry? It means landlords and commercial property owners could default, and bankruptcies and foreclosures numbers will be larger than expected. The longer COVID keeps rearing its ugly head, and the longer residents remain unemployed or underemployed, we could see an unprecedented need for Property Preservation companies to come in and maintain a slew of vacant properties.

5 Things Property Preservation Servicers should expect after June 30, 2021:

- Increased need for handling administrative tasks such as processing work orders, monitoring quality control, and collecting and managing data. Identifying a BPO specialty company can save property preservation companies time and money.

- Increased demand for processing bids, requiring tight turn-around times (TAT), especially on vacant foreclosed properties. Choosing the right third-party servicer to handle the behind-the-scenes activities is necessary for managing time and resources more effectively.

- Increased demand for scheduling inspections and providing accurate and complete reporting. When the need for inspections skyrocket, trying to identify available inspectors is critical. As the pool of available inspectors becomes fewer, having a BPO servicer working on approving vendors and scheduling your appointments saves valuable time and gets the reports into the system within guidelines set by the lender or bank.

- Increased number of in-field preservation agents and need for vendor-management oversight. In-field preservation agents handle the inspections and compile their notes. They rely on third-party servicers to coordinate all necessary activities once an agent has submitted his/her findings.

- Increased demands from banks and lenders for certification documents, for insurance claims, maintenance, inspections, and repairs. Banks and lenders are always left holding the empty bag when a property is foreclosed upon. The exterior needs to be kept clean, hazards disposed of and rules followed for securing a vacant property. Most of this work is farmed out to a long list of providers. Finding a company capable of managing the work, collecting the reports, and filing insurance paperwork is critical in periods of extremely high volume.

Americans have high hopes that most everyone will make it through this pandemic, through months of unemployment, through unprecedented business closures, and come out of this unscathed. However, no one knows what the other side of this pandemic era will bring. The one thing we do know is that after June 30, 2021, we need to be prepared for the post-COVID outcomes; look at worst-case scenarios and be ready for it; get all our ducks in a row; then buckle down the hatches, and forge ahead.