There is always talk about deregulating the mortgage industry and warnings on how the government will take over the private sector of managing mortgage services. Based on decisions the CFPB is planning to make, we could see a situation as bad as the recession of 2008 or as good as it can get Post-COVID.

This week, several printed statements and bulletins have been released by the Consumer Finance Protection Bureau (CFPB). For the first time in many months, there appears to be a light at the end of the tunnel. It’s a little hard to say that government intervention is great, but in this case, it could be a lifesaver for millions of Americans living in homes that could be facing foreclosure on June 30, 2021.

On April 5, 2021, the CFPB announced mortgage servicing changes that must be put into place as an “emergency measure” to save homes, reduce the likeliness of homeless families, and ensure banks and lenders stay afloat as the nation is trying to edge its way back from the pandemic.

The question at the top of the list to be dealt with is: Will the CFPB forbid residential servicers from starting a foreclosure until December 31, 2021?” Rules are being proposed to avoid as many foreclosures as possible before the federal emergency protections expire. CFPB has also asked for public feedback on the suggested measures and the effective dates that could be put into place to lessen the number of foreclosures.

“The nation has endured more than a year of a deadly pandemic and a punishing economic crisis. We must not lose sight of the dangers, so many consumers still face,” said CFPB Acting Director Dave Uejio. “Millions of families are at risk of losing their homes to foreclosure in the coming months, even as the country opens back up. Last week we warned that servicers need to be prepared for a high volume of borrowers exiting forbearance, and today we are proposing additional guardrails and tools for servicers as they navigate the coming months. We will do everything in our power to ensure servicers work with struggling families to find solutions that prevent avoidable foreclosures.”

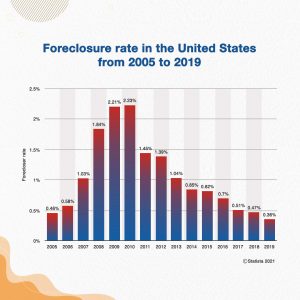

In December of 2020, 6 percent of mortgages were delinquent. That number translated to approximately 3 million borrowers who were behind on their mortgages as of March 30, 2021. At the end of Q32021, CFPB predicts that 1.7 million borrowers will come out of forbearance protection. Unlike the catastrophic fall of the mortgage industry during the 2006-2014 Housing Crisis, the COVID catastrophe has been managed through every phase of the pandemic. In comparison to the Housing Crisis, which resulted in 10M homes going into foreclosure, the pandemic crisis will likely see less than 1 million if the government stays diligent in its mission to save Americans’ homes. Although the numbers are still very high, the end results will show the impact the CARES Act has had on keeping the economy moving full force ahead.

For those of us who have been handling COVID-19 databases for servicing compliance, we have seen the deadlines for managing this crisis inch their way along month after month. In March of 2020, servicers were given until July 1, 2020, to assist borrowers with Home Retention and Liquidation Workout Options. The criteria listed for disaster relief modifications were:

- The homeowner’s hardship must be resolved, and

- The homeowner must be capable of continuing to make the full monthly contractual mortgage payment, and

- The homeowner must be unable to reinstate the mortgage or afford a repayment plan.

By June 24, 2020, the rules had already changed. COVID didn’t go away as many had thought; in fact, the situation grew worse. So, the criteria for foreclosure changed:

- The suspension of foreclosure activities was extended through August 31, 2021, and

- During this period, services may not initiate any judicial or non-judicial foreclosure process, or

- Move for a foreclosure judgement or order of sale, or execute a foreclosure sale.

By October 1, 2020, federally backed loans had yet another 90-day extension taking the COVID Borrower Protections out through December 31, 2020. By this time, it was apparent that COVID was not going away; numbers of those infected with the virus rose, deaths rose, and so did the number of borrowers put into forbearance.

On April 1, 2021, CFPB issued a press release that “warns mortgage servicers to take all necessary steps now to prevent a wave of avoidable foreclosures this fall.” To avoid needless foreclosures, the CFPB will be grading servicers on a list of preventive measures:

6 CFPB Warnings Servicers Must Pay Close Attention to over the next three quarters of 2021:

- Being proactive. Servicers should contact borrowers in forbearance before the end of the forbearance period, so they have time to apply for help.

- Working with borrowers. Servicers should ensure borrowers have all necessary information and help borrowers obtain documents and other information needed to evaluate the borrowers for assistance.

- Addressing language access. The CFPB will look carefully at how servicers manage communications with borrowers with limited English proficiency and maintain compliance with the Equal Credit Opportunity Act and other laws.

- Evaluating income fairly. Where servicers use income in determining eligibility for loss mitigation options, servicers should evaluate borrowers’ income from public assistance, child support, alimony, or other sources in accordance with the Equal Credit Opportunity Act’s anti-discrimination protections.

- Handling inquiries promptly. The CFPB will closely examine servicer conduct where hold times are longer than industry averages.

- Preventing avoidable foreclosures. The CFPB will expect servicers to comply with foreclosure restrictions in Regulation X and other federal and state restrictions to ensure that all homeowners have an opportunity to save their homes before foreclosure is initiated.

Previously, only federally backed loans were required to conform to Covid hardship rules. For the first time, the government suggests private lenders be put into the mix of providers that will need to adhere to CFPB emergency measures. It is noteworthy to mention that many larger lenders, banks, and servicing shops have been providing conventional loan borrowers with many of the same options that have been extended to VA, FHA/HUD, USDA, Fannie Mae, and Freddie Mac borrowers. Those who have already taken steps to include all types of borrowers will come out ahead of others. Fewer foreclosures, fewer bankruptcies, and less economic failure are what will get the country back on track. Unlike 2007, we have taken a step-by-step process to ensure a full-blown Housing Crisis is kept at bay. It’s in everyone’s best interest to push the efforts out 9 more months, or even a year, to ensure the best outcomes possible for all Americans.