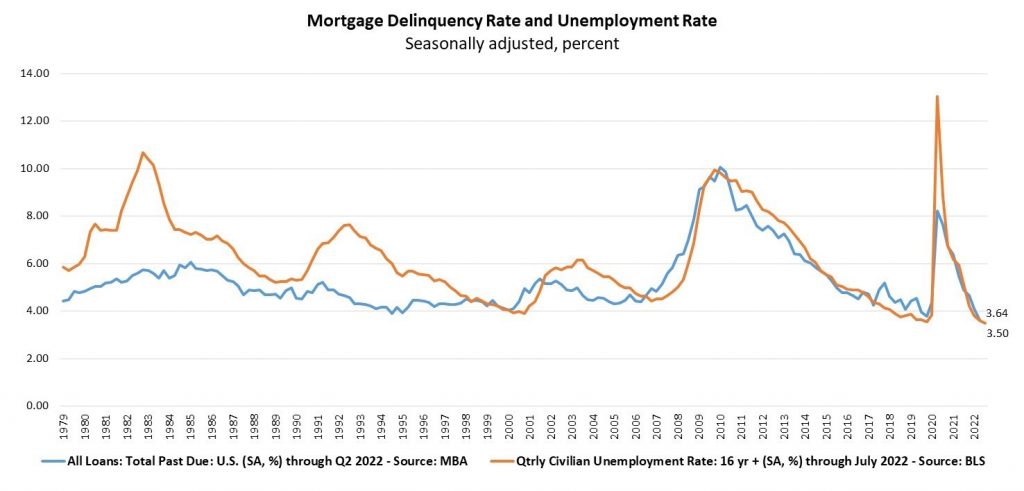

Default mortgage servicing was always an essential part of the mortgage processing value chain, and in recent years, the industry has gone through unprecedented demand flux. Between the recession of 2008 and the COVID-19 pandemic, delinquency rates have seen several ups and downs, compelling mortgage service providers to adapt. The graph below illustrates the flux in delinquency and default in the past few decades, which has made default servicing a challenge for mortgage providers.

Even as delinquency rates have come down in the last few quarters, mortgage default is predicted to rise again due to a massive increase in total household debt in the US – to the tune of $312 billion in Q2 of 2022 alone. Therefore, it is vital that mortgage providers prepare for the future, and explore new ways to streamline default servicing processes.

Read More: New Opportunities, Old Silos: Why Mortgage Lenders and Servicers Must Break Free

What Are the Challenges in Default Mortgage Servicing?

Today, the mortgage industry faces X challenges when it comes to default servicing – unpredictable volumes, extended forbearance protections, third-party vendor unreliability due to a shift to rural areas, and disparate systems.

- Unpredictable volumes: As mentioned, US mortgage providers are finding it difficult to predict delinquency and default trends due to inflationary pressures, fluctuating employment levels, and, of course, the pandemic. Advanced data models are needed that can feed on real-time and hyper-localized information to provide more accurate estimates, starting with a data fabric.

- Extended forbearance protection: Forbearance protection laws, while necessary, do throw a wrench in the works for default mortgage servicing unless the mortgage provider is extremely cautious. In some cases, delinquency can fall through the cracks, and the lender will be unable to sell the property until it is too late. One such case was a California couple holding off foreclosure for 13 years. To address this, lenders need to work with partners closely familiar with forbearance laws and how to navigate them, providing enough manpower for end-to-end delinquency and default servicing coverage.

- Third-party vendor unreliability: This has become a major problem as home buyers shift to rural locations in response to rising property prices. When there is a default in a remote region, it can be difficult to find local vendors – particularly for property preservation management – to assist in default servicing. Lenders must enlist proven partners that are able to provide preservation support in all regions.

- Disparate systems: Finally, disparate systems, unorganized data, and legacy technology are another challenge hindering default mortgage servicing. Since there is no data exchange between different applications, there is a risk that servicing deadlines and tasks will be overlooked in a period of high volumes. Disparate systems both add to operational costs and can lead to lost opportunity costs in the case of poorly managed foreclosures.

Read More: Features of Blockchain That Can Benefit the Servicing Sector

How to Streamline Default Mortgage Servicing?

In addition to resolving the challenges discussed above, lenders can proactively adopt default servicing solutions for mortgages. This includes:

1. Collections and repayment optimization

An efficient collection and repayment system can help minimize payment discrepancies and reduce the pressure on default mortgage servicing. Back-office teams can use digital workflows to plan payment recovery, dispatch letters of demand, assess and classify borrowers, stay compliant, and regularly follow up with all involved stakeholders. In fact, this is an essential part of a robust default servicing solution for mortgages.

2. Accurate analysis and summarization of default cases

Business intelligence solutions like Power BI can provide lenders with an accurate picture of default cases so that they can plan servicing strategies accordingly. This is required at two levels – highlighting green, yellow, and red flags to maximize the opportunities arising from every foreclosed property, and comprehensive summaries for record purposes. A strong data capability can also minimize loan modifications allowed for ineligible borrowers, preventing losses in the long term.

3. Streamlined data management for audits

Audits are a routine component of default mortgage servicing, and it is useful for lenders in several ways. It ensures that no default scenario slips through the cracks and that there is timely processing of all claims. It is typically advisable to partner with a third-party provider for audit purposes since it is a data-intensive task. The partner can leverage cognitive tools like artificial intelligence (AI) to streamline audits and generate cost savings.

4. Outsource default servicing solutions for mortgage

Outsourcing solutions allow mortgage providers to scale up or down at ease, coping with changes in demand and delinquency flux. The outsourcing partner can also take care of vendor management for property preservation and mitigate the losses resulting from defaults. Given the intricate processes necessary for default servicing, a partner conversant with foreclosure laws, follow-up guidelines, and claims recovery can prove to be of immense help.

5. Mortgage servicing automation

Automation is a crucial technology for streamlining most of the processes on the mortgage value chain, and default servicing is no different. For example, e-filing tools can reduce the efforts needed for document generation and management, and automated document checks can aid in compliance. Automated AI assistance can also interact with customers more efficiently, answer their queries, and find the right data from large repositories.

Read More: Hot Take: AI Could be the Answer to Every Mortgage Servicing Problem Today

At Nexval, we explore the convergence of cutting-edge technology and emerging mortgage trends to provide lenders with tailored solutions for their default mortgage servicing needs. In the next few years, the US economy will remain highly dynamic, reflected in fluctuating delinquency rates and new opportunities as well as challenges from foreclosures. Speak with our Tech Gurus to learn about how a powerful default servicing solution for mortgages can help you navigate this landscape.

Frequently Asked Questions About Default Servicing

Q1. How to create an effective mortgage default management process?

For effective mortgage default management, processes and sub-processes should be arranged and optimized, infrastructure should be in-sync with the market demands, document management should be free from errors, and the workforce should be equipped with all the relevant tools.

Q2. What should you look for when hiring a default servicing outsourcing partner?

When choosing a default servicing outsourcing partner, make sure you look out for these qualities:

- Experienced resources with industry knowledge

- Verified clientele

- 24/7 support

- Valid licenses and certifications

- Cost-effective solutions

- Technological expertise

Q3. What are the benefits of streamlining default servicing?

Default servicing is a complex process that can pose challenges many challenges if not streamlined. However, if the servicers manage to streamline the default servicing process, they can reap several benefits, such as:

- Adherence to new regulatory policy and updates

- Increased operational capacity

- Increased scalability

- Reduced risk of errors

- Minimized loan modifications

- Access to accurate analysis of default loans